Open Bank Account Online: Step-by-Step Guide for Beginners (2026)

Opening a bank account online has become extremely easy in India. In 2026, most banks offer 100% digital savings account opening with minimal documents and fast verification. If you are a beginner and want to know how to open a bank account online, this complete guide will help you step by step.

This article covers eligibility, documents required, online process, types of bank accounts, benefits, common mistakes, and FAQs.

What Does It Mean to Open a Bank Account Online?

Opening a bank account online means completing the entire account opening process digitally using a smartphone or computer. There is no need to visit a bank branch physically in most cases.

Today, banks use e-KYC, Aadhaar verification, PAN validation, and video KYC to verify customers securely.

Types of Bank Accounts You Can Open Online

- Savings Account – Most common for individuals

- Zero Balance Account – No minimum balance required

- Salary Account – For salaried employees

- Student Account – Designed for students above 18

Who Can Open a Bank Account Online?

You can open a bank account online in India if:

- You are an Indian resident

- You are above 18 years of age

- You have Aadhaar and PAN card

- Your mobile number is linked with Aadhaar

Documents Required to Open a Bank Account Online

- Aadhaar Card (linked with mobile number)

- PAN Card

- Active mobile number

- Email ID

- Signature (digital or physical Capture during Vidoe KYC)

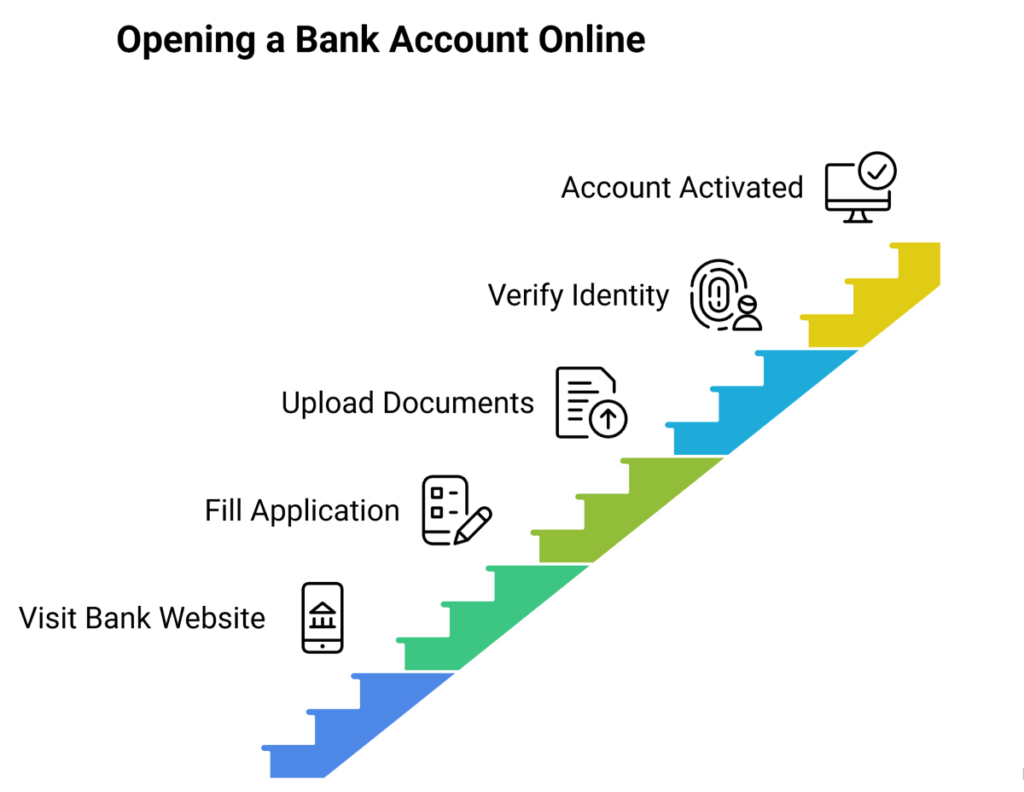

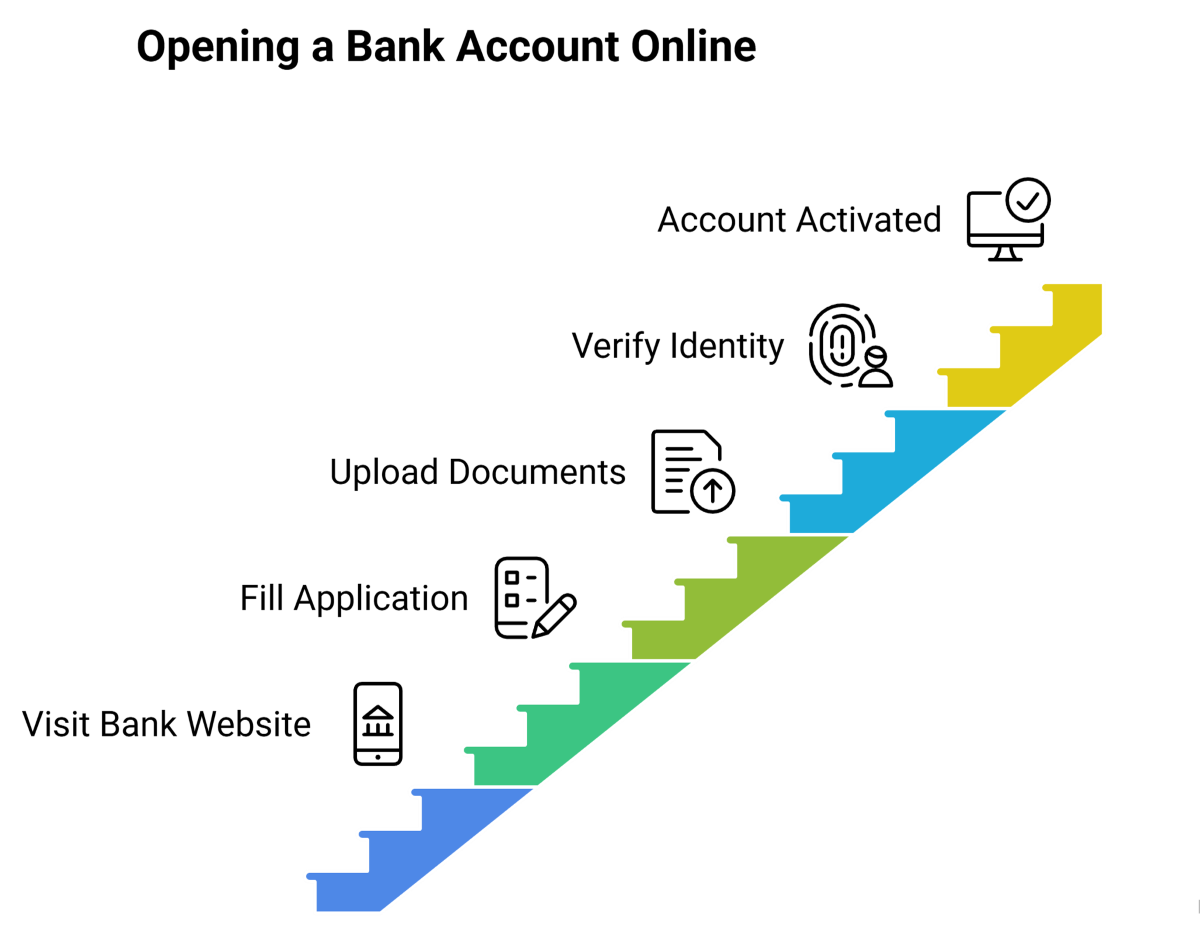

Step-by-Step Process to Open a Bank Account Online (2026)

Follow these simple steps:

- Visit the official website or mobile app of the bank

- Select Open Savings Account

- Enter basic details like name, mobile number, and email

- Verify OTP sent to your mobile

- Enter PAN and Aadhaar details

- Complete e-KYC or video KYC

- Submit the application

How Long Does It Take to Open a Bank Account Online?

In most cases, the bank account is opened within:

- Instant to 24 hours – After Video KYC

- 1–3 working days – Traditional banks

Debit card and cheque book are delivered within 5–7 working days.

Benefits of Opening a Bank Account Online

- No branch visit required

- Paperless process

- Fast account activation

- Zero balance options available

- 24×7 access to banking services

Things to Check Before Opening a Bank Account

- Minimum balance requirement

- Debit card charges

- ATM withdrawal limits

- Mobile banking features

- Customer support quality

Common Mistakes Beginners Should Avoid

- Ignoring minimum balance rules

- Providing incorrect KYC details

- Not completing video KYC

- Opening multiple unused accounts

Is Online Bank Account Opening Safe?

Yes, opening a bank account online is safe if you apply through the official bank website or app. Banks use encrypted systems, OTP verification, and RBI-approved KYC methods.

Conclusion

Opening a bank account online in 2026 is simple, fast, and secure. Beginners can easily complete the process from home using Aadhaar and PAN. Always compare features and choose a bank that suits your needs.You can visit Bank Buddy India website for all major bank saving account link.

Frequently Asked Questions (FAQs)

Can I open a bank account online without visiting a branch?

Yes, most banks allow 100% online account opening with e-KYC or video KYC.

Is PAN mandatory to open a bank account online?

Yes, PAN is mandatory for most savings accounts in India.

Can students open a bank account online?

Yes, students above 18 years can open a bank account online.

How much money is required to open an online bank account?

Many banks offer zero balance accounts, while others may require an initial deposit.

Which is the best bank to open an account online?

The best bank depends on your needs like zero balance, digital services, and customer support.