Table of Contents

Introduction

What is the Classic Banking Programme?

Benefits of HDFC Classic Banking

Features and Privileges

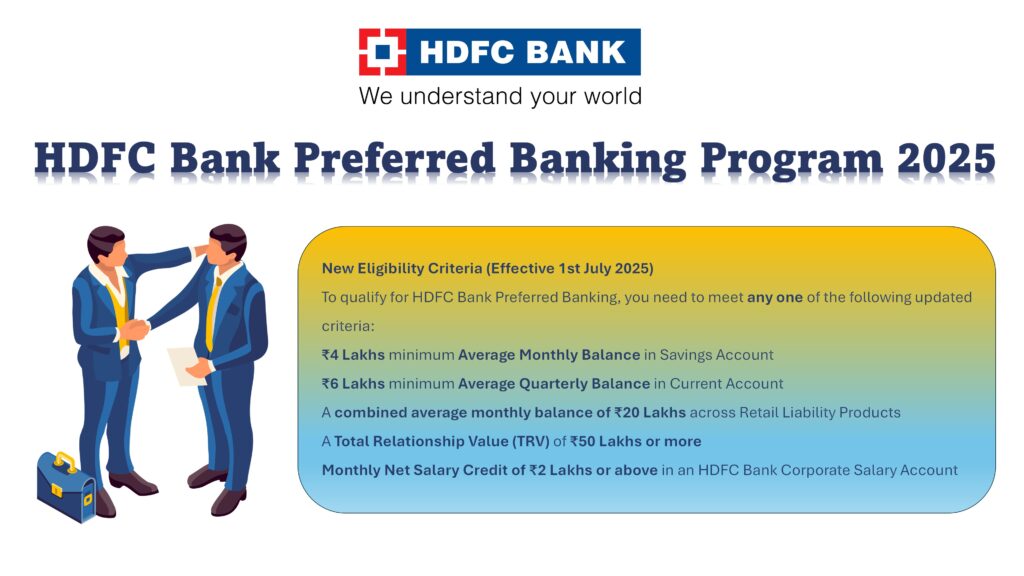

Updated Eligibility Criteria (Effective July 1, 2025)

Total Relationship Value (TRV) Explained

Charges and Waivers for Classic Customers

How to Apply or Upgrade to Classic Banking

Programme Terms and Group Linkage

Conclusion

Introduction

In today’s competitive financial landscape, premium banking services are no longer a luxury but a necessity for many. HDFC Bank’s Classic Banking Programme is crafted to meet the evolving financial needs of customers who seek not just banking but a relationship-driven, personalized financial journey. This comprehensive blog explores every dimension of the Classic Banking Programme, including its benefits, eligibility criteria, and major updates effective from July 1, 2025.

.

What is the Classic Banking Programme?

HDFC Bank’s Classic Banking Programme is a premium service offering elevated banking solutions to customers with a strong banking relationship. It is designed to provide an enhanced banking experience, access to exclusive benefits, relationship manager support, and priority service across branches and digital platforms. The programme links your banking relationship across various HDFC Bank products to deliver a unified and rewarding banking experience.

Benefits of HDFC Classic Banking

The Classic Banking Programme provides a wide range of benefits, covering everyday banking, wealth management, and lifestyle services. Here are the major benefits:

a. Personalized Services

Dedicated Relationship Manager (RM)

Customized banking solutions

b. Preferential Pricing

Waiver of certain service charges

Discounted locker rentals

Forex transaction benefits

c. Exclusive Debit Card Benefits

Classic Platinum Chip Debit Card

Annual fee of Rs. 850 waived under the programme

d. Zero Charges for Common Banking Transactions

Free issuance of chequebooks (Savings Account)

No fees on NEFT/RTGS via online banking

Nil DD/MC issuance charges up to Rs. 1 Lakh per day

e. Lifestyle & Forex Privileges

40% discount on select Forex Cards

Up to 5 paise better exchange rate on select currencies

f. Demat & Investment Privileges

Discounted AMC for Demat accounts

Priority access to investment products

Features and Privileges

| Feature | Classic Programme Benefit |

|---|---|

| Debit Card Annual Fee | Rs. 850 waived |

| Locker Rentals | 25% Discount on first locker per group |

| Forex Transactions | Better rate up to 5 paise |

| Forex Card | 40% discount on issuance fee |

| Chequebook | Free for savings accounts |

| DD/MC Charges | Nil up to Rs. 1 lakh/day |

| ATM Transactions | Unlimited domestic ATM usage |

| Cash Transaction Limit | Up to 5 free or Rs. 2.5L/month free |

| NEFT/RTGS (Online) | Free |

| Demat AMC | Rs. 500 (nil transactions), Rs. 250 (1+ transaction) |

| Insta Alerts, Bill Pay | Free |

| Standing Instructions | Free |

Eligibility Criteria

Starting July 1, 2025, HDFC Bank has updated the eligibility norms for its Classic Banking Programme. Here are the criteria:

Customers qualify if they meet any one of the following:

Savings Account: Maintain an Average Monthly Balance (AMB) of Rs. 1 Lakh

Current Account: Maintain an Average Quarterly Balance (AQB) of Rs. 2 Lakhs

Combined Balance: AMB of Rs. 5 Lakhs or more across Retail Liability Value

TRV: Total Relationship Value of Rs. 10 Lakhs or more

Salaried Individuals: Monthly net salary credit of Rs. 1 Lakh or more in HDFC Corporate Salary Account

Important Notes:

The Fixed Deposits considered must have a tenor of at least 6 months.

Combined balances include linked group accounts.

Total Relationship Value (TRV) Explained

TRV aggregates the following components:

Average balances in Savings and Current Accounts

Average balances in Fixed Deposits (tenor > 6 months)

Mutual Fund and Investment value via HDFC Bank

20% of outstanding value of Retail Loans from HDFC Bank

20% of Demat account balance

Insurance premium of all policies via HDFC Bank

TRV is considered at both Customer ID and Group ID level, enabling combined family/group banking benefits.

Charges and Waivers for Classic Customers

Waived or Discounted Charges:

Debit Card Fee: Waived

Locker: 25% discount on first locker per group

DD/MC Issuance: Free up to Rs. 1 lakh/day

NEFT/RTGS (Online): Free

Demat AMC: Rs. 250 (1+ transaction), Rs. 500 (nil transactions)

ATM Transactions:

Unlimited Domestic Usage: No charges for HDFC or other bank ATMs

Cash Transactions:

Up to 5 free transactions or Rs. 2.5 lakh free per month (Savings Account)

Cheque Returns:

Rs. 450 (1st), Rs. 500 (2nd), Rs. 550 (3rd onwards)

Rs. 350 for funds transfer, Rs. 50 for technical reasons

How to Apply or Upgrade to Classic Banking

Customers can apply or upgrade via:

Branch Visit: Talk to your Relationship Manager or Branch Executive

NetBanking/Mobile Banking: Request upgrade if eligible

PhoneBanking: Contact 24×7 customer support

Programme Terms and Group Linkage

Eligibility is measured at Customer ID or Group ID level.

A “Group” includes family members or businesses with linked accounts.

The Group’s combined balances and investments help meet eligibility.

For customers onboarded before June 30, 2025, changes take effect from Oct 1, 2025.

For upgrades/downgrades after July 1, 2025, new eligibility applies immediately.

Conclusion

HDFC Bank’s Classic Banking Programme offers a blend of personalized services, exclusive benefits, and financial advantages tailored for discerning customers. With updated eligibility norms and broader inclusion through group relationships, the programme now fits a wider range of customers—from salaried individuals to business owners and investors. If you’re seeking more from your banking experience, upgrading to Classic Banking is a strategic financial move worth considering.

📞 For more information, contact your nearest HDFC Bank branch or visit https://www.hdfcbank.com